Over the years, the significance of the Union Budget has come down and doesn’t have such an impact on our everyday lives, and hence doesn’t interest too many of us anymore. That said, there are still some, especially those in the finance businesses, for whom listening to the Budget is a yearly ritual.

But given the negative news as well as poor economy numbers over the last couple of quarters, we would dare say that the FY21 Budget presented last week had more than a usual number of people waiting for it. For most, last week would have been one of anticipation for Saturday to arrive and hope that the finance minister has something up her sleeve to magically move the economy into 4th gear, trigger consumption, improve rural incomes, increase investment, ease credit flows and banking woes and overall reverse the prevailing sentiment, while of course ensuring that the fiscal deficit doesn’t scarily worsen.

Many articles have already dissected the Budget presentation as well as the detailed document post that, so we will not attempt a repeat of that. But even for the most disinterested observers, the least they would have expected is how the budget will put more money into our pocket or at least ease our difficulties in dealing with taxes. So, we have looked at how this year’s budget has panned out for your personal finances and identified 6 changes which could affect you personally.

- Changes in Income Tax structure

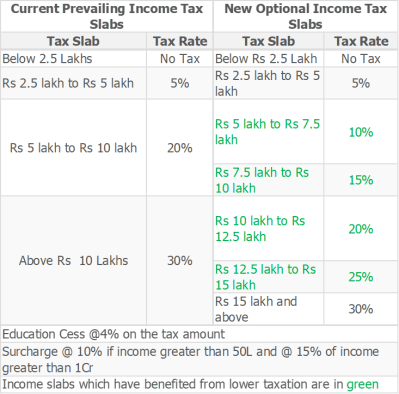

Who doesn’t love choices? Whether its plain simple breakfast or choosing your next outfit we love it when we have choice, don’t we? However, that doesn’t seem to apply to Taxation structures. This year’s budget has changed the tax slabs but left the choice of sticking to the previous tax slabs or switching to the new ones to you. The catch is if you switch to the new tax slabs, you cannot avail of any of the deductions & exemptions currently available. Here is a quick look at the tax slabs that are currently in existence and the new ones which you can choose to switch to.

How do you decide which of the two options you should choose? What you need to look at is the deductions and exemptions you are currently availing of. The most popular ones being

- Rs 1.5 lakh under 80 C, the default option for most being EPF (ELSS, PPF, Life Insurance, School fees, Principal repayment of home-loan etc)

- Medical insurance premium under section 80D of Rs 25,000 for self and Rs 50,000 for senior citizen parents (total of Rs 1,00,000 if both self and parents are senior citizens)

- Additional deduction of Rs 50,000 for investments in NPS

- Deduction of 2L on interested paid on a home loan under section 24(b)

Broadly, if you are claiming home loan interest deduction apart from 80C, you are better off with the previous tax slabs. But if you are not and do not have default investments like EPF for claiming deductions under section 80C and you are currently investing in products especially for the deductions, you can opt for the new slabs.

Finwise Take → While there is a choice being given currently, the intention clearly articulated has been to move away in the coming future from the exemption and deductions being offered currently. Given this scenario, if you are buying a house or starting a new NPS account primarily to avail of the exemption you may want to rethink your decision.

Currently, a large number of investment decisions are made (and products are sold) at the last moment, primarily on their tax-saving features. We think this is a good step since the products thus bought will pass the tests of suitability towards risk profile and time horizon, and will help investors create substantially more wealth than now. You would be better off seeking the help of a financial advisor to help you make the right decisions customised to your needs, especially given the above.

- Increased insurance cover for FDs

Currently each depositor in a bank is insured upto Rs 1,00,000 inclusive of both principal and interest. This budget has increased this insurance limit to Rs 5,00,000, and this would help increase coverage and bring a greater number of impacted people under the insurance fold in case of bank defaults. This will give a lot of comfort, especially to senior citizens, for whom this is the investment of choice.

Finwise Take → While increased insurance cover is a welcome step, it can give investors, especially senior citizens who look for that extra percentage point to prop up their meagre savings, a false sense of security about otherwise “dangerous” investment options in this space.

Our belief is that this insurance benefit is a “perceived” comfort. This insurance is payable by the Deposit Insurance and Credit Guarantee Corporation of India, a subsidiary of the RBI. DICGC will wait for the “defaulter” bank to be liquidated and de-registered, post which the DICGC receives claims from the banks and then pays out the claims, post necessary validations. The wait can be many years for impacted customers, and this risk is definitely not worth taking for extra percentage point of interest.

Our advice to our customers has always been to be safe with debt investments and not take any kind of risk with debt. Credit risk while investing in banks like PMC was ignored and has now come to the forefront. Insurance or no insurance, it is important not be lured by a few percentage points higher return. We often tell our customers to beware of higher interest rates, which some banks or institutions are offering, since higher-then-prevailing interest rate means higher than intended risk, which is opaque to the retail investor and our stance holds going forward too.

- TDS introduced for FDs in cooperative banks

Now, cooperative banks will also need to deduct tax at source on fixed deposits and recurring deposits if the interest exceeds 40K (50K for Senior citizens).

Finwise Take → Earlier this was another big draw for investors to invest in co-operative bank FDs, apart from the higher interest rates. This welcome move will encourage people to think beyond tax and interest rate, while choosing their bank for FDs.

- Cap of 7.5L on exemption to retirement contribution by employer

As of now employer contributes 12% of basic towards EPF, Rs. 1,50,000 towards super annuation and 10% of basic towards NPS, and any amount of contribution to retirement benefits is exempt from income tax ie. is deducted from your gross income to calculate taxable income. The new budget has introduced a cap to this exemption, from the next FY, only contributions upto Rs 7,50,000 put together towards all retirement benefits will be exempt and any contribution over and above that will be taxed at your slab rate.

Finwise Take → This is a big change and has a significant impact on high net-worth individuals having corporate careers. Senior corporate professionals earning approx. Rs 1 cr or above are likely to be impacted by this while, of course, actual impacts will be dependent on individual salary structures. For eg. someone earning a basic of Rs 2,50,000 per month, will have an annual retirement benefit contribution of Rs 8.1 lakh (assuming contributions to all 3 benefits – EPF, Super-annuation & NPS), and will cross this tax-exempt threshold. For people with such high salaries, this will mean rejigging compensation structures to reduce institutionalized retirement benefits, which in turn will have the negative impact of also reducing the retirement corpuses that these benefits create, requiring such individuals to plan better individually for their retirement.

- No more Dividend Distribution Tax

Currently, dividends received from shares and mutual funds are not taxed in your hands, they are paid post payment of DDT. DDT for shares is 20.56%, equity mutual funds is 11.64% and debt mutual funds is 29.12% before paying out the dividends. With new budget provision the dividend will be added to your income and taxed as per your income slab.

Finwise Take → While this is a welcome step for corporates, especially MNCs, since dividend income to MNC shareholders was earlier taxed and is now free, it not such good news for retail investors, especially those in the higher tax brackets.

If you have a largely direct-equity portfolio, the dividend yield will fall substantially. You should consider shifting to equity mutual funds under the growth option where the tax outflow is capped at 10% long-term capital gain, that too on redemption, for investments over one year.

If you have invested in equity mutual funds (both pure equity & equity hybrid) in the dividend option, you should shift to the growth option immediately, for reasons similar to above, since the differential impacts here are even higher than in direct equity.

For debt mutual funds, the approach was dual. For people either in lower tax brackets or for long-term debt allocations (> 3 years), it always made sense to remain in growth, since both tax slab rate and LTCG on debt is lower. Whereas only for investors in the highest tax slab for short term investments (< 3 years), dividend option was better, since the STCG on debt is as per tax slab. With this change now, across the board, growth is the option to go with in debt mutual funds.

Also, one needs to remember that this has made tax-returns filing a bit more cumbersome, since dividend incomes now need to be added to overall incomes to calculate taxes, which earlier was not the case, with DDT.

Just in case an investor in the lower tax bracket is holding on to debt funds under the dividend scheme (due to poor advice or ignorant purchase), they will be hugely benefited as they would need to pay tax as per slab which is lower than the 29.12% being paid by the debt funds.

- Key changes for NRIs

Announcements in this section set the cat among the pigeons for NRIs, before clarifications led to clarity and calm. Some key changes

- Taxation of global incomes of NRIs who are not tax-resident in any other country

- Definition of Resident-tax – 120 or more days in India (reduced from earlier 182 days)

- Definition of Resident but not ordinarily-resident – transition period increased to 4 years (from earlier 2 years)

Finwise Take → After giving a big scare to NRIs based out of the Middle East regarding taxing global income, there has been clarity that global income of residents of any country will not be taxed. While this doesn’t impact people resident in tax-free countries, people working in the merchant navy etc. may be impacted, since their long-period travels across the world may lead them to fall into this category of Non-Resident Indian but not resident of any other country.

In addition, such people will be doubly impacted by the second clause above, since they need to ensure they live in India for less than 120 days to classify as non-resident, as against 182 days earlier.

The last clause above is beneficial for NRI’s returning to India after living abroad for many years since it will give them more time without taxing their global income.

Do note that these are broad-based observations and not necessarily one-size-fits-all, do consult your financial planner / advisor for customized advice on your particular situation.

Finwise is a personal finance solutions firm that helps both NRI and resident individuals and families plan for their financial goals, follow their passions and achieve financial independence.

To receive our articles through email, pl/ subscribe here.

For advice, please reach us at getfinwise@finwise.in or +91 9870702277/9820818007.